If monthly salary is RM 5000 with a yearly bonus of RM 5000 then for an employee who is not married the combined tax for both salary and bonus is RM 650. The tax calculator provides a full step by step breakdown and analysis of each tax Medicare and social security calculation.

Lewis Hamilton Becomes F1 S Highest Paid Driver With Nearly 500 Million In Career Earnings

Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

. It aims to be the minimalist alternative to the Official PCB calculator. The malaysia income tax calculator uses income tax rates from the following tax years 2019 is simply the default year for this tax calculator please note these income tax tables only include taxable elements allowances and thresholds used in the malaysia annual income tax calculator if you identify an error in the tax tables or a tax credit. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay.

Get tax saving worth RM300000 for childcare expenses for children up to 6 years old. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Employer Employee Sub-Total - EPF Contribution.

The eFile Tax App handles all related foreign. The income tax slab and rates for FY 2021-22 is important as it is needed to calculate income tax amount while filing ITR this year. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

Calculations RM Rate TaxRM 0-2500. The Malaysia Tax Calculator can help you calculate Profit Loss accounts deduct all allowable expenses deduct tax relief given by the government prevent you from claim unallowable expenses that can be penalised preparing documents needed and many more. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus-only tax.

It aims to be the minimalist alternative to the Official PCB calculator. Assessment Year 2020 Assessment Year 2019 Assessment Year 2018 Assessment Year 2017 Assessment Year 2016 Assessment Year 2015. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and children relief.

This income tax calculator can help estimate your average income tax rate and your take home pay. Say your chargeable income for Year Assessment 2021 is RM65000. On the First 2500.

Assessment Year 2018-2019 Chargeable Income. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower.

Include your income deductions and credits to calculat. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Based on this my basic salary after tax would be about RM15 The spreadsheet has been updated to include the 2019 Budget announcement of an increase in the Low and Middle Income Tax Offset for 2018-19 onwards including 2019-20 This hasnt changed from 2019-20 GovLoop is the Knowledge Network for Government - the premier social network.

Your taxes are before minus tax rebate. The first RM50000 of your chargeable income category E RM1800. This means that you get a full Federal tax calculation and clear understanding of how the figures are calculated.

The relief amount you file will be deducted from your income thus reducing. Income tax rate Malaysia 2018 vs 2017. Calculations RM Rate TaxRM.

The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and children relief.

The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2019. The Income-Tax Department NEVER asks for your PIN passwords or similar access information for credit cards banks or other financial accounts through e-mail For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers Your average tax rate is 21 As proposed in the 2016 Budget tax payer will also be eligible to claim a deduction up to a. Income tax rates 2022 Malaysia.

This marginal tax rate means that your immediate additional income will be taxed at this rate Tax benefits personal allowance. Domestic travel travelling within Malaysia expenses have RM100000 tax relief. On the First 5000.

How many income tax brackets are there in Malaysia. Then download print and mail them to one of these 2018 IRS mailing address es listed here. The rates of assessment year are taken into consideration.

Client Login Create an Account. The next RM10000 of your chargeable income 21 of RM10000 RM2100 Total tax payable RM6500 before minus tax rebate if any Lets do another example. Use the PriorTax 2018 tax calculator to find out your IRS tax refund or tax due amount.

You can no longer e-File your 2018 IRS andor State Returns. Calculate Estimate Your 2018 Tax Year Return This 2018 Tax Return Calculator is for Tax Year 2018. Number of children Below are the Individual Personal income tax rates for the Year of Assessment 2020 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia Social Security retirement benefits are for.

Income Tax in Malaysia in 2019. You can check on the tax rate accordingly with your taxable income per annum below. Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of sporting facilities payment of registration or competition fees.

Tax Preparation Clarks Summit Pa

公积金网上计算机epf Calculator 帮你计算你的退休所需存款

Mileage Log Template Free Excel And Pdf Template With Download

Mileage Log Template Free Excel And Pdf Template With Download

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Meet The 11 Billionaires Cashing In On Bitcoin S Wild Rise

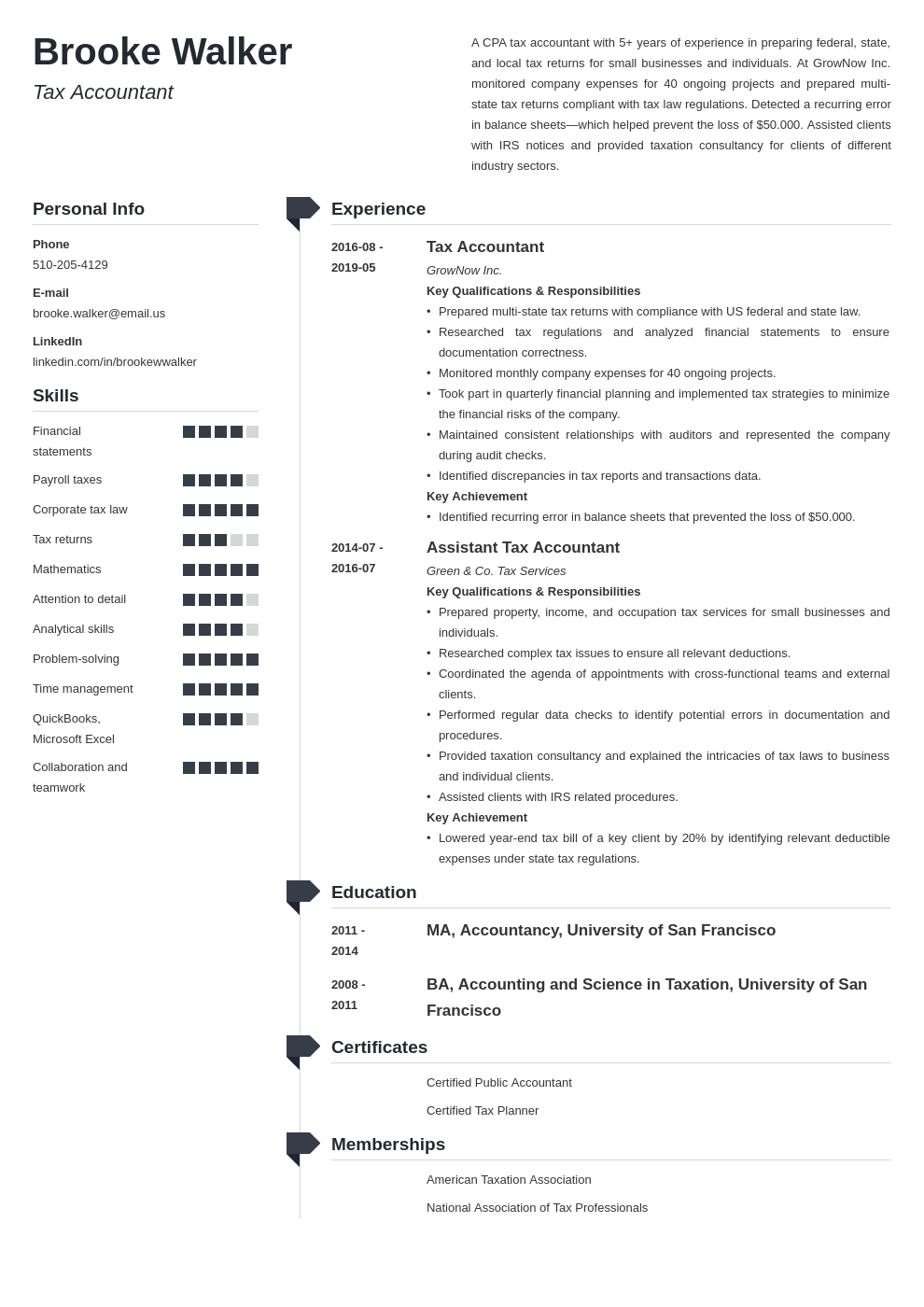

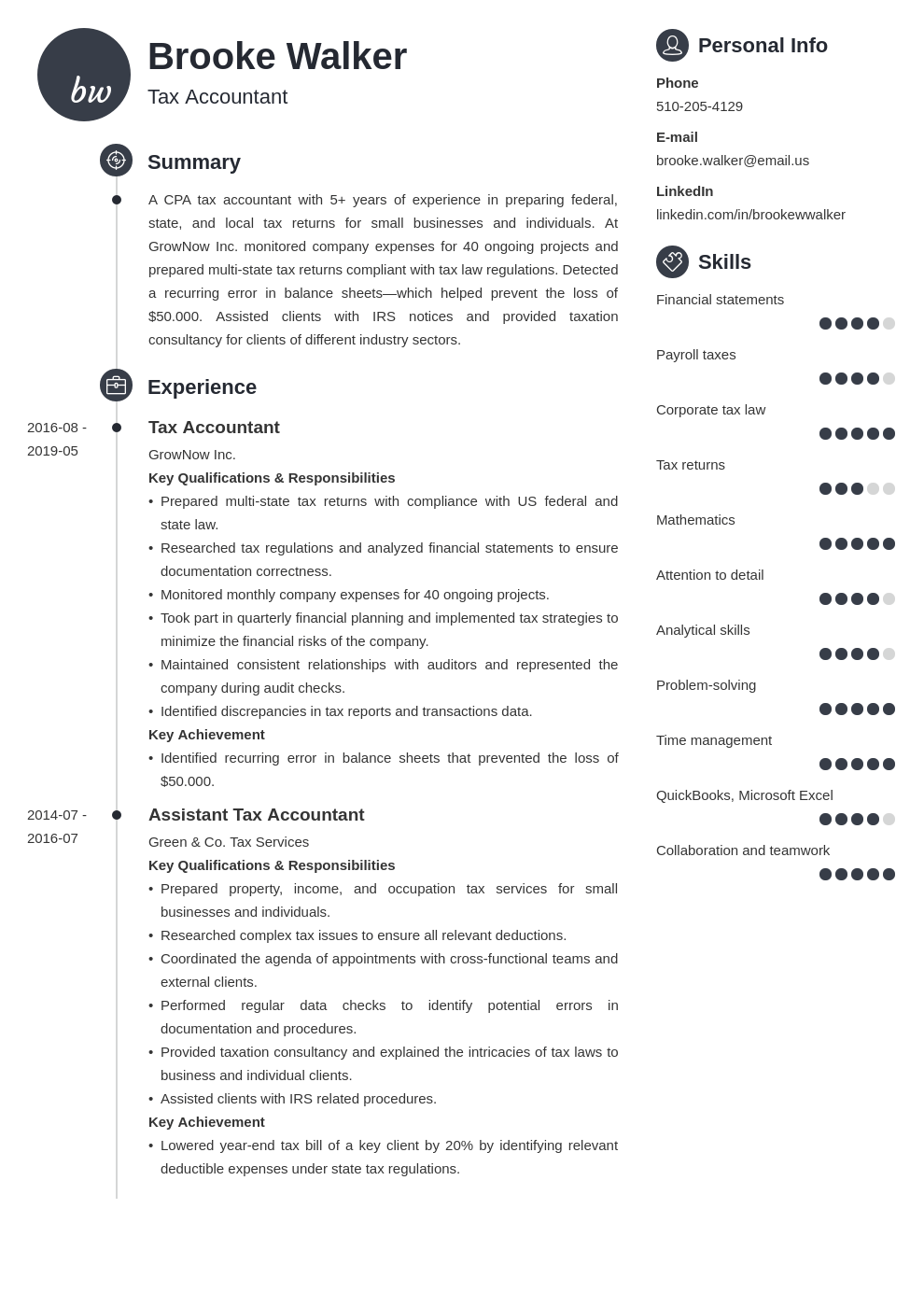

Tax Accountant Resume Sample Guide 20 Tips

Tax Accountant Resume Sample Guide 20 Tips

Return On Capital Employed Learn How To Calculate Roce

Elon Musk Wants The Electric Vehicle Tax Credit To Disappear Joe Manchin Might Oblige

Download Teacher Salary Slip Excel Format

Elon Musk Claims He Will Pay More Than 11 Billion In Taxes This Year

What You Need To Know Before You Register For Sales Tax

Free Photo Company Representatives Reading Applicant Resume At Hiring Recruitment Agencies Biotechnology Jobs Work Experience